How to Analyze a Property: Start Here

The world today is filled with talk of data driven decisions, AI Analysis, computer programs and statisticians running complex equations to make accurate decisions on everything from baseball to stock market bets. The good news is that the analysis that you can utilize for real estate is reliable and not nearly so overwhelming and complicated. Anyone can use it, and we are here to teach you how!

Why Do You Need to Know How to Analyze a Property?

If becoming a DIY Investor is something you are looking to pursue, analyzing a property will ultimately tell you how much a property will cost or make. Knowing how to quickly analyze a property can help you decide if it is worth taking a deeper look, and drive the terms of your offer. An investor will likely want to look at a property for its income and how that compares to other properties or investment vehicles.

Although we, personally, have an investor focus, these analytical skills could come in handy even if you are just trying to buy a primary residence. While most people just ask what a bank will approve them for, utilizing the information in this post can help you determine your true costs for owning your first house, or your dream house. A homeowner might want to compare their cost of ownership to rent or a current house they plan to move out of.

What Information Goes Into an Analysis

Typically when a rental property makes money it is called cash flow. We highly recommend investing for positive cash flow, and will focus much of our advice and content on it.

Cash Flow: The money a property makes after all expenses are accounted for. Positive cash flow allows you to make money off your investments month after month, it allows you to hold a property indefinitely or until it is advantageous to sell.

So let’s dive in to what you are typically going to need to know in order to make the most informed decision:

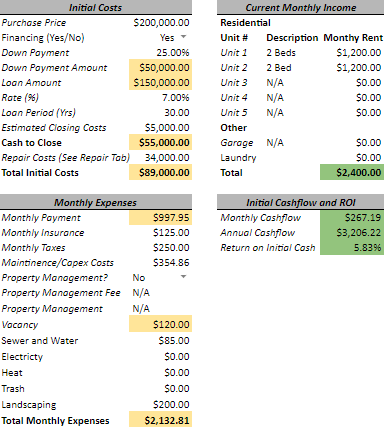

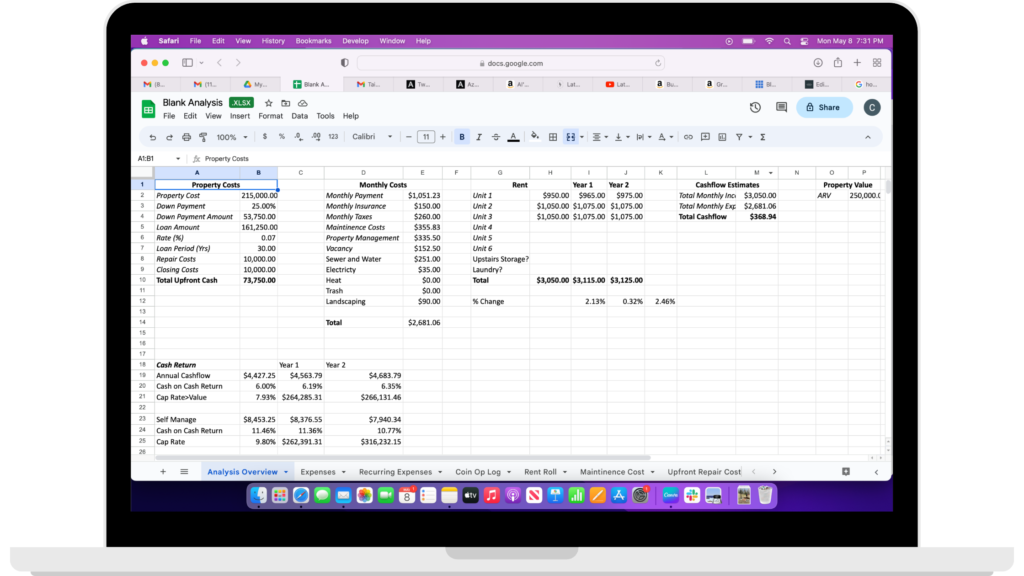

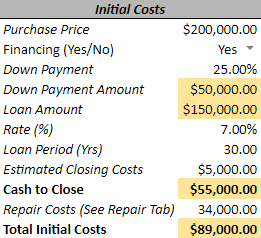

- Upfront costs:

- Price of the property

- Will it be financed? If so, how much of it?

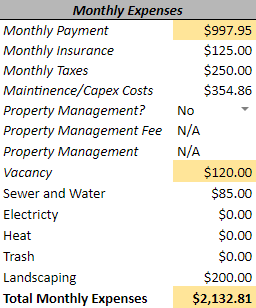

- Regular Monthly Expenses:

- What are the interest rate and terms of the loan?

- How much are taxes?

- How much is insurance?

- Are there any condo or Homeowner’s Association (HOA) fees?

- What utilities (gas, electric, etc.) will you be paying and how much will they cost?

- Will there be a property management company and what are their fees?

- Maintenance and Cap Ex:

- What additional expenses will be required such as septic pumping, snow plowing, heating system servicing, etc.

- What will the long term large Capital Expenditures or “Cap Ex” be (roofing, windows, HVAC, etc.)

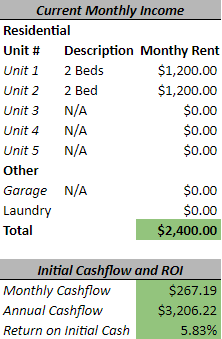

- Income:

- Monthly rental income from all units

- Additional income from other sources such as storage, parking, or coin-op laundry

Most of the time all of this information needs to be known (or accurately approximated) to complete a successful analysis.

Running the Numbers

The formula for determining how much money a property can make, or cost you, is as simple as subtracting all of the expenses from all of the income:

Total Monthly Income – Regular Monthly Expenses – Maintenance and Cap Ex = Cash Flow

Let’s take a property that has a mortgage of $1,200/month, taxes are another $350/month, insurance is $150/month, maintenance is $200/month, and the income from the property is $1,975/month then the simple formula is as follows:

$1,975 – ($1,200 + $350 + $150) – $200 = $75 per month cash flow

The property has positive cash flow! Is this all the information to consider? Probably not, there are multiple things the savvy investor will want to consider using this cash flow number.

Evaluating the Investment

Is the cash flow in the above example good? Well it depends heavily on what you are looking for. For a property you are going to live in or an investor banking on appreciation this could be really good. But for a long-term investor looking for cash flow this is probably not the best buy. That $75 per month could disappear very quickly if the estimated expenses are wrong or if taxes and insurance go up. In addition, this is likely not an ideal return for the money that had to be used to acquire the property. The $1,200 mortgage payment is based on a 7% loan and a $240k sale price with 25% (or $60k), down payment. As you can see, it would take a long time to make your $60k down payment back.

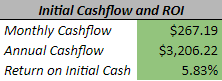

In fact this brings us to another major part of how to analyze a property, calculating your Return on Investment, or ROI, based on cash flow. If you are a potential homeowner or something other than a long-term investor, ROI based on cash flow is likely not driving your decisions, however, it can still be valuable to know how to calculate it. ROI is simply calculated by multiplying the monthly cash flow by 12, dividing by the initial cost of the property, and multiplying by 100 to get a percentage:

[(Monthly Cash flow*12)/(Upfront Cost)]*100 = ROI (as a percentage of your upfront cost)

Your upfront cost would consist of any initial cash used to acquire the property (down payment or full cash purchase) plus any upfront renovation or repairs. Using our example above we will assume the $60k down payment and $5k in upfront repairs. We believe it is always safe to assume that at least some money will be needed for deferred maintenance when purchasing a property. Plugging the numbers into the equation above gives you:

[($75*12)/($60k+$5k)]*100 = [($900)/($65k)]*100 = 1.4% ROI

This is typically called a “Cash on Cash” return. The reason we use it is because it shows your reliable, steady return on your investment based on the cash flow the property makes each month. Other returns, such as appreciation in the property value, are not necessarily steady and may not be realized until the property is sold.

This method of calculating ROI is used to show a steady reliable return and if the property is worth investing your money in. In this case 1.4% is not even as high as some high-yield savings accounts and this is probably not a great long-term investment to tie up your money in. Of course, there are always other factors to consider on a case-by-case basis and this example is just a general overview.

We will dive deeper into how to estimate expenses , what to consider in a property, and more in future posts. Additionally, many people may be wondering how to calculate the mortgage payment based on purchase price. There are a number of online calculators that can easily be found through a quick search. The one from Bankrate is simple and quick to use:

https://www.bankrate.com/mortgages/mortgage-calculator/

For more knowledge like this follow us on Instagram at @RentalsRehabsandMore!